Protecting Growth: A Beginner’s Guide to Small Business Insurance in Huntsville

As Huntsville’s small-business ecosystem accelerates, insurance is becoming a strategic necessity rather than an afterthought. From new retailers opening along South Parkway to agile tech consultancies in Cummings Research Park, the city’s entrepreneurial climate comes with new forms of risk—and securing the right insurance can be the difference between a temporary setback and a long-term disruption.

Huntsville is now ranked among the fastest-growing small-business markets in the nation, posting a 10.6% increase in business establishments in 2024. That momentum—combined with Alabama’s ranking as the #8th best state to start a business—has placed the Rocket City at the center of statewide economic vitality. Small businesses are not just part of the story; they are the story. Across Alabama, small firms account for 46.0% of employment and 41.3% of payroll, and Huntsville’s small-business sector plays an equally vital role in supporting the region’s workforce and economic stability.

Across Alabama, the pattern holds: small businesses make up 99.4% of all businesses and employ 46.7% of the private-sector workforce. During National Small Business Week this year, Gov. Kay Ivey called small businesses “the engine that keeps Alabama moving forward,” honoring Huntsville’s own Kimberly and Larry Lewis of PROJECTXYZ, Inc. as the state’s Small Business Persons of the Year. In her proclamation, Ivey highlighted small firms as job creators that “strengthen communities”—a sentiment echoed across Huntsville’s rapidly expanding commercial corridors. Against this backdrop of growth, insurance serves as both protection and strategy.

Why Insurance Matters in Huntsville

With small businesses driving such a large portion of Huntsville’s workforce, the stakes are high. A single lawsuit, property loss, or unexpected interruption can ripple far beyond one storefront—it can affect jobs, contracts, and even neighborhood development. As one local founder put it, “Growing in Huntsville feels like being part of a rocket launch. Insurance helps make sure one unexpected problem doesn’t shut the whole mission down.”

Key Types of Coverage to Consider

Huntsville’s small-business owners—whether launching a bakery in Madison, opening a boutique downtown, or providing engineering consulting near Redstone Arsenal—tend to face a familiar set of exposures. The most essential policies include:

- General Liability: Covers customer injuries and property damage.

- Property Insurance: Protects physical assets such as buildings, inventory, and equipment.

- Business Owner’s Policy (BOP): Bundles liability, property, and business interruption coverage at a lower cost.

- Business Interruption: Replaces lost income if you must temporarily close due to a covered event.

- Workers’ Compensation: Alabama requires coverage for businesses with five or more employees, including part-time staff and corporate officers.

- Commercial Auto: Protects vehicles used for deliveries, supply runs, or client visits.

- Professional Liability (E&O): Critical for engineers, consultants, writers, tech firms, and other service providers.

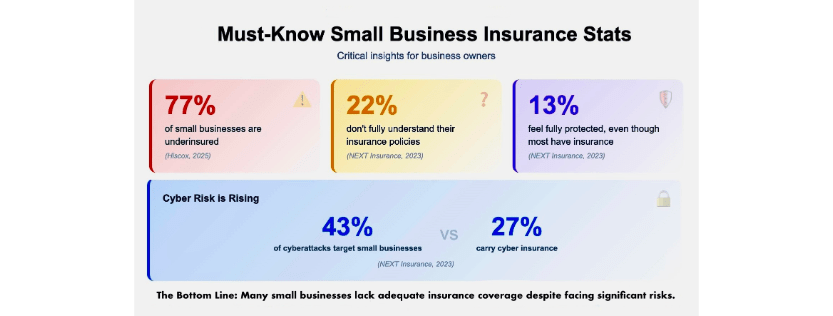

- Cyber Liability: Increasingly important as small firms become targets for cybercrime.

- Key Person Insurance: Protects the business financially if a crucial leader becomes unable to work.

What Influences the Cost?

Insurance costs in Huntsville—where the overall cost of doing business is estimated to be 12% below the national average—depend on several factors:

- Industry risk profile

- Number of employees and payroll

- Business location and property values

- Claims history

- Coverage limits and deductibles

- Whether policies are bundled into a BOP

Huntsville’s rapid growth means more commercial density, more customers, and more movement—factors that can increase overall exposure for smaller firms. But the city’s affordability and high business formation rate help offset costs, making early coverage more accessible than in many markets of similar size.

Local Guidance for Entrepreneurs

Experts recommend a few key steps for new or expanding businesses in Huntsville:

- Identify your risks clearly. List the realistic threats to your operations, from customer injuries to cyberattacks.

- Work with local brokers. Huntsville agents understand the area’s commercial landscape and typical coverage gaps.

- Seek multiple quotes. Insurers vary widely in pricing and coverage details.

- Start with a strong foundation. A BOP plus Workers’ Compensation (if you qualify) covers most basic risks.

- Review annually. As your business grows, your insurance should evolve with it.

Protecting the Future of Huntsville’s Economy

With small businesses creating more than 80% of Alabama’s net new jobs in recent years, protecting local entrepreneurs protects the broader community. The right insurance helps founders hire confidently, invest in property, pursue new contracts, and weather unexpected issues with less financial strain.

For Huntsville small-business owners, insurance is no longer just a compliance box. It’s a long-term growth tool—and a critical part of sustaining the momentum that has made the Rocket City one of the nation’s most dynamic places to build a business.

For a full list of local small-business insurance providers, visit the Huntsville/Madison County Chamber of Commerce directory here.