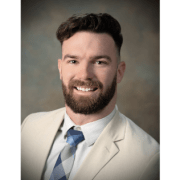

Retirement Foundations: A Conversation with Morgan Stanley’s John Jeffery, Corporate Retirement Director and Financial Advisor

John Jeffery

305 Church Street, Huntsville, AL 35801

John.Jeffery@morganstanley.com

256-650-4015

John Jeffery | Huntsville, AL | Morgan Stanley Wealth Management

John Jeffery is an experienced financial services professional concentrating in corporate retirement plans. John has worked in Huntsville’s Morgan Stanley office since 2010 and has served as a Corporate Retirement Director since 2012, focusing exclusively on retirement plan solutions for businesses.

He holds several industry-recognized certifications, including the Chartered Retirement Plans Specialist SM (CRPS ®) and Qualified Plan Financial Consultant (QPFC) designations.

John holds a Bachelor of Arts degree in Economics from Vanderbilt University.

Recently, John spoke with the Huntsville Business Journal about the work that he does to help businesses design and manage comprehensive retirement plans for their employees.

Sarah: Can you tell me a bit about the companies that you work with? How are they similar or different in terms of employee count, industry, location, and other factors?

John: My team manages retirement plans for over 100 companies, primarily defense contractors, with operations in Huntsville. Our clients range from start-up businesses with one employee to established companies with 1,000+ employees. The factors that they all have in common are a growth orientation, deep trust in their partners, and an enduring commitment to their employees’ financial wellbeing. We serve clients with 401(k), 403(b), ESOP, cash balance, and nonqualified deferred compensation plans.

Sarah: At what point do you recommend an organization seek out the services of a Corporate Retirement Director? Is it a function of the size of the company, assets under management, or some other combination of factors?

John: Ideally our clients start working with us before they make their first hire. This lets us help them design a retirement benefits structure that can help attract and retain the talent that they need to succeed.

Sarah: What unique resources can a Corporate Retirement Director contribute to a company that they might not otherwise have access to?

John: Morgan Stanley’s Corporate Retirement Directors offer access to first-class resources that are designed specifically to tackle the hurdles our clients and their employees face. We offer personalized employee engagement solutions including in-person support. Employees at our client companies may receive personalized advice and insights from the vast resources of Morgan Stanley. We host in-person seminars for companies as well as one-on-one meetings that are available for all employees. These meetings can be to assist with rollovers, money coaching, education planning, financial planning, or helping create an estate planning strategy.

Sarah: How does Morgan Stanley support their Corporate Retirement Directors so they can provide a high level of service to the companies they work with?

John: As a Corporate Retirement Director, Morgan Stanley serves as investment fiduciary for many of my clients’ plans. This means that we have a duty of loyalty to act in the sole interest of our clients’ employees. We also have a duty to the highest standard under the law to help ensure that we use care, skill, prudence, and diligence in every action for the sole benefit of the employees that we serve. Morgan Stanley supervises a fiduciary plan management model for our Corporate Retirement clients to help ensure that all aspects of a plan are addressed through a quarterly review schedule, which covers the following plan essentials: Plan Governance, Fee Structure, Investments, Employee Support, and Vendor Management.

Sarah: About 2% of Morgan Stanley’s 16,000 Financial Advisors are Corporate Retirement Directors as of December 2024. What additional education and training did you pursue to become qualified to be a CRD?

John: I attended the College for Financial Planning to get the Chartered Retirement Plans Specialist (CRPS) designation. I continued my training with the National Association of Plan Advisors to get the Qualified Plan Financial Consultant (QPFC) designation.

Sarah: Can you share a few examples of how you’ve helped clients or their employees navigate important retirement-related challenges?

John: Three situations come to mind. We frequently use the saying that you will never look better in a bathing suit than you will today. That doesn’t mean that you shouldn’t save for retirement. But it does mean that you need to find a balance between your need for assets in the future and your need for meaningful experiences with people you love today.

Our team has helped companies that purchase businesses bring each new company on board, merge the retirement plans together when appropriate, and welcome the new employees into their company. We strive to help make the transition process simple and efficient.

We provide education to the participants to help them understand their retirement benefits.

Sarah: What methods have you seen companies employ to incentivize, or encourage, employees to take full advantage of their company’s retirement plan?

John: Huntsville is full of incredible HR professionals that develop creative ideas to increase participation in retirement plans. The most important incentive is for a company to offer a matching contribution for employees who save. We work with companies to create fun events like “Taco Bout Retirement” lunches or ice cream socials like “Get the Scoop on Retirement” to help employees get enrolled in the plan. Finally, most of our clients also offer quarterly seminars or webinars to encourage employees to engage deeply with important financial topics like budgeting, investing, debt reduction, Social Security, or Medicare. We often joke that the average American spends more time planning a vacation than preparing for retirement and we work with our HR and executive leadership every day to reverse this trend.

Sarah: How do you measure your success in this role? Both in terms of the performance of the retirement plans that you manage and in terms of your personal impact?

John: Our goal is for every employee in our retirement plans to be prepared physically, emotionally, and financially for retirement. We want our clients and their employees to find the intersection of health and wealth. Many of our clients have enough money to retire, but they don’t have hobbies, volunteer opportunities, friendships, or communities that will provide a sense of purpose and fulfillment in retirement. We hope that our ability to connect with people allows us the opportunity to guide people in not only their retirement, but also their overall financial wellness.

John Jeffery is a Financial Advisor with the Wealth Management division of Morgan Stanley in Huntsville, Alabama The views expressed herein are those of the author and may not necessarily reflect the views of Morgan Stanley Smith Barney LLC, Member SIPC SIPC – Securities Investor Protection Corporation Morgan Stanley Financial Advisor(s) engage Huntsville Business Journal to feature this article]. John Jeffery may only transact business in states where he is registered or excluded or exempted from registration https://advisor.morganstanley.com/john.jefferyTransacting business, follow-up and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where John Jeffery is not registered or excluded or exempt from registration. The strategies and/or investments referenced may not be appropriate for all investors.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Individuals should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts, estate planning, charitable giving, philanthropic planning or other legal matters.

When Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors and Private Wealth Advisors (collectively, “Morgan Stanley”) provide “investment advice” regarding a retirement or welfare benefit plan account, an individual retirement account or a Coverdell education savings account (“Retirement Account”), Morgan Stanley is a “fiduciary” as those terms are defined under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Internal Revenue Code of 1986 (the “Code”), as applicable. When Morgan Stanley provides investment education, takes orders on an unsolicited basis or otherwise does not provide “investment advice”, Morgan Stanley will not be considered a “fiduciary” under ERISA and/or the Code. For more information regarding Morgan Stanley’s role with respect to a Retirement Account, please visit www.morganstanley.com/disclosures/dol. Tax laws are complex and subject to change. Morgan Stanley does not provide tax or legal advice. Individuals are encouraged to consult their tax and legal advisors (a) before establishing a Retirement Account, and (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a Retirement Account.

Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please visit us at http://www.morganstanleyindividual.com or consult with your Financial Advisor to understand these differences.

Morgan Stanley Smith Barney LLC. Member SIPC. CRC 4617892 08/25

______________________________

Sponsored Content